When it comes to selling your home, one of the most important decisions you’ll make is setting the right listing price. Price it too high, and you might scare away potential buyers; price it too low, and you could miss out on money you deserve. In “Pricing Your Home: How to Determine the Right Listing Price,” you’ll find straightforward advice and helpful tips to help you find that perfect balance.

This guide will walk you through the steps to evaluate your home’s value, understand market trends, and make informed pricing decisions that attract buyers while ensuring you get a fair return on your investment.

Table of Contents

ToggleWhy Pricing Matters

Pricing your home correctly is essential for a successful sale. If you set the price too high, potential buyers might think your home is overpriced, causing it to stay on the market for a long time. This can lead to price cuts that make your home look less appealing. On the other hand, if you price it too low, you might sell quickly, but you could end up missing out on extra money that you could have earned from the sale.

Setting the right price helps attract serious buyers who are ready to make offers. A well-priced home generates interest and creates a sense of urgency among buyers. Additionally, your asking price plays a crucial role in negotiations and can give you an advantage in competitive situations. Overall, finding the right balance in pricing not only helps sell your home faster but also maximizes its value.

Key Pricing Methods

Determining the right listing price involves a mix of research, data, and expert guidance. Below are the most common and effective pricing methods:

1. Comparative Market Analysis (CMA)

A Comparative Market Analysis (CMA) is an essential tool for determining the value of your home based on similar properties in the area. This method involves evaluating recently sold homes, currently listed homes, and properties that were previously listed but didn’t sell.

How a CMA Works:

-

- Analyzing Recently Sold Properties: The most reliable comparables are homes that have recently sold. These properties provide insight into what buyers are willing to pay for homes like yours.

-

- Comparing Similar Features: Look for homes with similar square footage, lot size, and features. Ideally, they should be in the same neighborhood or a nearby area with similar market conditions.

-

- Adjusting for Unique Characteristics: Not all homes are identical, so adjustments are necessary. For example, if your home has a larger backyard or a recently remodeled kitchen, the price should reflect these improvements.

Example Comparison:

-

- Similar Home A: 2,000 sq ft, sold for $350,000

-

- Similar Home B: 2,100 sq ft, sold for $365,000

-

- Your Home: 2,050 sq ft, potential price range: $357,500

2. Online Valuation Tools

In today’s digital age, homeowners can quickly get an estimate of their home’s value using online valuation tools. Platforms like Zillow, Redfin, and Realtor.com offer free home value estimates based on public data and market trends.

Accuracy Comparison:

-

- Zillow’s Zestimate: ±4.5% median error rate

-

- Redfin Estimate: ±4.7% median error rate

-

- Realtor.com: ±5.2% median error rate

While these tools offer convenient and fast estimates, they often lack the nuance of a detailed CMA or professional appraisal, as they cannot account for unique home features or the specific local market dynamics.

Professional Appraisal Insights:

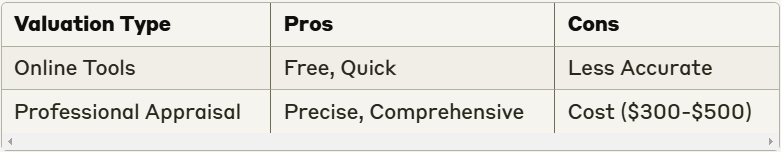

Professional vs. Online Valuation

Common Pricing Mistakes to Avoid

Setting the right price isn’t just about finding a number—it’s about avoiding mistakes that can hinder your success. Here are some common errors sellers make when pricing their homes:

1. Emotional Pricing

Many sellers tend to overvalue their home based on personal feelings or memories. While your home may have great sentimental value, its market price is determined by what buyers are willing to pay, not how much you’ve invested in it or how many memories it holds. Be realistic and avoid pricing based on emotional attachment.

2. Ignoring Market Trends

The real estate market is dynamic, with pricing influenced by seasonal trends, interest rates, and local demand. Failing to monitor market trends can lead to overpricing or underpricing your home. It’s essential to keep an eye on the larger market picture and adjust your expectations accordingly.

3. Neglecting Home Condition

A home in poor condition will often struggle to fetch a fair market price. If there are visible maintenance issues or outdated features, these should be addressed before listing. Consider getting a pre-listing inspection to identify and fix potential problems before they affect your home’s value.

Strategic Pricing Strategies

Once you understand the key methods for pricing, you can implement strategies to maximize your home’s market appeal.

1. Psychological Pricing Techniques

Psychological pricing can make a significant difference in how buyers perceive the value of your home. For example:

- End prices with .99 or .97: Buyers tend to view a price like $299,999 as significantly less than $300,000, even though the difference is only $1.

- Precise Pricing: Using precise numbers (e.g., $324,750 instead of $325,000) can create a perception of value, making the listing appear more carefully considered.

2. Pricing Bands

Different price points appeal to different buyer segments. Consider the following:

- Under $300,000: Targets first-time homebuyers.

- $300,000 – $500,000: Suitable for middle-market buyers.

- $500,000+: Attracts luxury buyers.

By understanding the buyer pool for your home’s price range, you can tailor your price to appeal to the right market segment.

3. Data-Driven Pricing Formula

Listing Price = (Comparable Sales + Unique Home Features + Market Trends) × Local Demand Factor

Bottom Line:

Pricing your home right is key to a quick, profitable sale. This guide offers practical tips, from using CMAs to avoiding common mistakes like emotional pricing. With smart strategies and data-driven advice, it helps you attract buyers and maximize your home’s value.

Pro Tip: Your first two weeks on the market are critical. Price strategically from the start.